Should You Be Worried About The Economy Tanking As A Startup CEO?

The short answer is yes. Yes, you should be worried about the economy tanking.

Do you want to grow your business? Maybe I can help. Click here.

We’ve seen the stocks lose significant value over the past couple of days. Now, stock prices and the economy is not the same thing. The economy can keep growing when stock prices reduce.

I don’t have crystal ball, and I don’t know whether stocks will continue to go down over the next few months or not. But I do know that the stock market is overvalued, and that eventually there will be a major correction.

And when that major correction comes, your company will likely be affected.

I’ll come back to what I think you should do to protect yourself and your company later.

I’ve been tracking stock data over twenty years. And the stock market, even after the free fall of the last couple days, is in rarified air.

How rare is it for stocks to be valued this high?

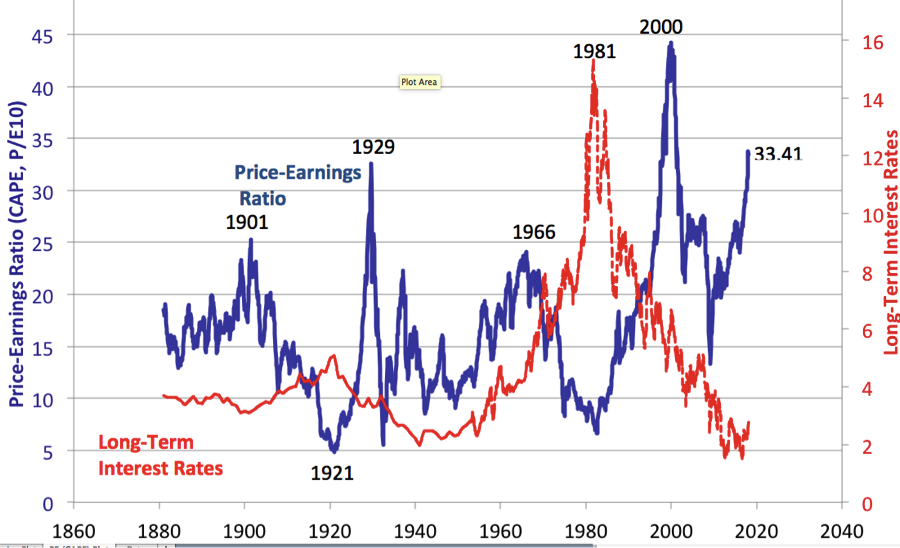

What if I told you there have been only two periods since 1871 when stocks have been valued this high: 1929 and 2000? And we know how those stories ended…

Well, depending upon whether you use the Case-Shiller CAPE ratio or my own Overvalued/Undervalued Index (OU Index for short), maybe 2-4% of the time has the stock market been this high.

The odds are the stock market will correct soon.

The question is when?

The answer: no one knows.

But I know numbers. And I know probability theory.

And the probability is in favor of a correction.

Let’s look at the Case-Shiller data and explain what the Case-Shiller CAPE ratio is. The CAPE (Critically Adjusted Price Earnings) ratio was developed by economists John Y. Campbell and Robert Shiller.

Campbell and Shiller concluded that "a long moving average of real earnings helps to forecast future real dividends", and this is related with returns on stocks.

The CAPE ratio is a modified Price-Earnings ratio. It is the current price of a stock divided by the average of the last 10 years of earnings adjusted for inflation. The data consists of:

- Over 1740 monthly data points from 1871 – 20157

- 69 times the CAPE has been 27.85 or higher

- The CAPE’s highest value ever was 44.2 in December 1999

- The CAPE’s lowest value ever was 4.78 in December 1920

- There is no CAPE for the first 10 years of the index because the CAPE requires 10 years of trailing data

Now, 144 years is a helluva lot of data by any person’s standards. It makes the almost 20 years of data I have for the OU Index appear like a mere drop in the bucket.

As you can see, the current CAPE ratio of 33.41 is higher than when the depression hit in 1929. And the CAPE ratio is the highest it’s been since the dotcom bubble of 2000.

The CAPE ratio at these levels is a large reason why I am very concerned.

Let’s look closer at the times the CAPE was higher then 27.85. They are broken into three chronological blocks:

A. June 1929 – October 1929.

The stock market crash of October 28, 1929 ended the run. By November 1929 the CAPE dropped to 21 from 28.96 in October 1929, and the S&P comp lost 26% of its value.

B. January 1997 – May 2002.

Surely you recall the tech bubble. This 63-month run is longest the CAPE was over its current 27.85. It took over two years from the March 2000 tech bubble peak of 43.22 for the CAPE to go below 27.85. That shows you how big the tech bubble truly was.

C. February 2015 - ?. The big question mark. We don’t know how large the bubble will grow before it pops.

Robert Shiller only won the Nobel Prize in Economics in 2013 for his work. Maybe that’s not enough to convince you.

How About The Overvalued/Undervalued Index?

The Overvalued/Undervalued index places stocks into three buckets and assigns a numerical value of 1, 0, or -1 to the stock depending upon the bucket. A company’s 10-year growth rate versus the company’s trailing P/E ratio determines the rating:

- Undervalued = 1. A stock with a P/E greater than 2X its 10-year growth rate or a PE greater than 50.

- Reasonably Valued = 0. A stock with a P/E of 1X to 2X its 10-year growth rate.

- Overvalued = -1. A stock with a P/E less than 1X its 10-year growth rate.

- The OU Index Value is determined by the average of all the stocks in the index.

The data consists of:

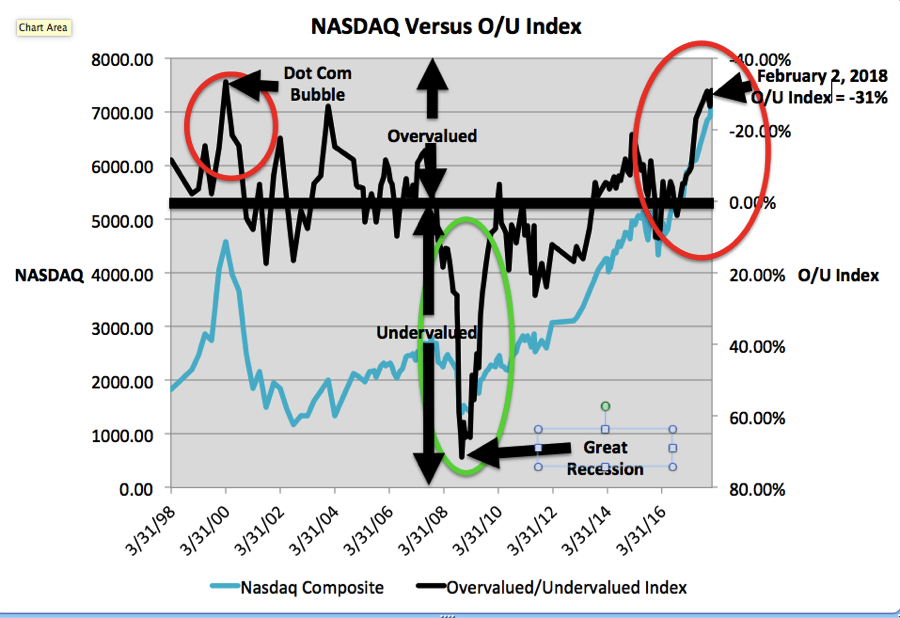

- Over 150 monthly data points from 1998 – 2018

- Two times the OU Index has been -18.75% or higher (the more negative the number, the more overvalued the index has become)

- The OU Index’s highest overvalued point ever was -33.3% in March 2000

- The OU Index’s lowest undervalued point ever was 71.53% in November 2008

- The OU Index has been overvalued 65 periods versus undervalued 67 periods. About half of the time the OU Index has indicated the stock market has been overvalued. About half of the time the OU Index has indicated the stock market has undervalued. This is a good indicator of the OU Index’s accuracy.

I’ve only been keeping data since 1998, but the OU Index has only been higher than -18.75% twice:

A. March 2000. The tech bubble peak.

The NASDAQ reached its peak of 5,048 on March 10, 2000. The OU Index reached its peak of -33.33% in March 2000.

B. December 2003. The post bubble bounce.

The NASDAQ reached its post bubble bottom of 1,114 on October 9, 2002. Then the NASDAQ bounced to 2,003.37, and the OU Index reached -26.51% on December 31, 2003. The NASDAQ was at 1,341.17 by March 31, 2004. That’s a 33% drop! Ouch!

Here’s the data on the OU Index:

Let me explain what you’re looking at. I’m comparing the O/U index (black) to the NASDAQ (blue). The red circles indicate where stocks were at their most overvalued, and the green circle indicates where stocks were at their most undervalued.

On the left you can see the Dot Com Bubble bursting in 2000. 33% of stocks were overvalued. That’s an all time high.

Then, in the center in green, you can see in November 2008 when over 70% of all stocks were undervalued during The Great Recession.

Now, as of February 2, 2018, you can that stocks are approaching the valuations of the Dot Com Bubble with over 31% of all stocks overvalued. That’s why I’m concerned.

You don’t want believe me.

That’s fine.

Well, do you believe outgoing Fed Chairwoman Janet Yellen? Yellen said in an interview with CBS (https://www.cbsnews.com/news/janet-yellen-the-exit-interview/) that stocks are overvalued.

The economy is interconnected. A drop in stocks can affect your company. Here’s how.

There are three key issues that will affect your startup if the economy slows:

A. Fundraising.

I lived through and somehow survived the nuclear winter of 2008 and 2009 while I was trying to raise money. However, I’d be lying if I didn’t say it wasn’t scary.

The point is raising money can become next to impossible if the economy takes a turn for the worst. We don’t know what will happen this time, but be smart:

- Close your funding as quickly as you can.

This is always the rule you should follow, but especially now when we might be entering a time of economic uncertainty. Have the thought process that every day matters because every day does matter!

You’re not funded until the money is in the bank. It’s really difficult for an investor to shut you down if you have your funding in the bank.

If you haven’t started raising money yet, then plan on it taking a little longer. Raising funding might take six months in good times. I’d double that time to at least one year if the economy is slowing. Then…

B. Look Hard At Your Revenue.

It’s good practice to always have a worst-case plan. And it’s always smart developing your worst-case plan before the economy takes a turn for the worst.

So develop a plan for your revenue slowing or dropping; whatever you think the worst thing that can happen. Dig deep and make sure you’re ready to take some really tough measures including lay offs if necessary. Finally…

C. Recruiting gets tougher when the economy slows.

In theory, there should be more candidates when the economy slows down because there are more unemployed employees. However, the best talent is usually gainfully employed.

You’ll learn, if you haven’t already, that it’s hard to pry great people away from their jobs during an economic slowdown.

There have been nine stock market corrections of 30% or more since 1900!

I did a little research just for fun. The Dow has fallen over 30% nine times since 1900. That’s almost one 30% correction every 10 years:

| Year | Dow Drop | Recovery Date | Total Recovery Time |

| 1901-1903 | 46% | July 1905 | 2 Years |

| 1906-1907 | 49% | September 1916 | 9 Years |

| 1916-1917 | 40% | November 1919 | 2 Years |

| 1919-1921 | 47% | November 1924 | 3 Years |

| 1929-1932 | 89% | November 1954 | 22 Years |

| 1939-1942 | 40% | January 1945 | 3 Years |

| 1973-1974 | 45% | December 1982 | 8 Years |

| 2000-2002 | 36% | September 2006 | 4 Years |

| 2008-2009 | 52% | April 2011 | 2 Years |

| Average | 49% | 6 Years | |

| Median | 46% | 3 Years |

In every speculative bubble that ever happened, some “expert” said, “It’s different this time.”

This bubble will be no different.

Here’s what we don’t know: February 2015 -?.

What is the date of the ?. No one knows.

Life is unpredictable! And the economy and stocks are definitely unpredictable!

Bad things happen to really good people. You can take steps now just in case something unpredictable happens.

Do You Want To Grow Your Business? Maybe I Can Help. Click Here.

Picture: Depositphotos

CAPE Index graphic and data courtesy of https://www.econ.yale.edu/~shiller/data.htm