Why You Should Ignore The Rise Of The Unicorns

"I hate high-margin businesses," one of the most famous VCs in Silicon Valley told me during my pitch.

“There’s not a hope in hell this guy’s going to fund us," I thought to myself.

I ignored his comment, and I continued on with my presentation.

So what did this world-renowned VC mean? I asked one of his partners, and I’ll paraphrase what the partner told me:

“He (the well-known VC) believes that, as long as the top line is growing, nothing else matters. Someone (other investors) will always come around and put more money in the company at a higher valuation. Eventually, the valuation gets high enough, and we can IPO the company.”

So, in other words, pump up the value of the company, so the investors can cash out when the company IPOs.

Fundamentals?

Profitability?

Who gives a shit?!? Just pump up the value.

This thought process comes pretty close to a Ponzi scheme. Here’s the SEC’s definition of a Ponzi scheme:

“A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors to create the false appearance that investors are profiting from a legitimate business.”

Why do Ponzi schemes collapse? Again, from the SEC:

“With little or no legitimate earnings, Ponzi schemes require a consistent flow of money from new investors to continue. Ponzi schemes tend to collapse when it becomes difficult to recruit new investors or when a large number of investors ask to cash out.”

How Do You Pump Up The Volume? Unicorns To The Rescue!

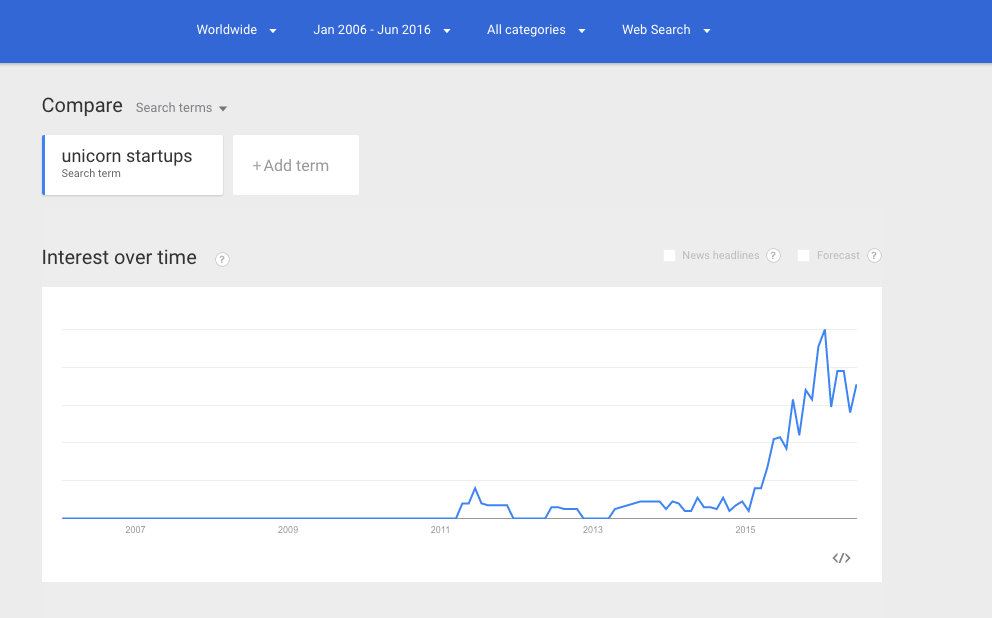

When I first started working with VCs in the late 1990’s, the term "Unicorn" didn’t even exist. Now, $1B “Unicorns” have become seemingly the only thing that matters:

The reasons Unicorns have become so sexy (and talked about) are obvious:

- For VCs: Having a Unicorn that you can successfully liquidate can generate a positive return for the whole fund

- For entrepreneurs: It’s like in The Social Network when Sean Parker says to Mark Zuckerberg, “…and that’s where you’re headed, a billion dollar valuation.” Who doesn’t want that? To be the next Facebook would be really cool.

https://www.youtube.com/watch?v=dU6scly2AFU

However, Facebook was a profitable company with a sound business model when they IPO’d. Many of the current crop of recent VC-backed technology IPO's aren’t profitable:

| Year | % Of IPOs That Were Profitable At IPO1 |

| 2012 | 44% |

| 2013 | 28% |

| 2014 | 17% |

| 2015 | 26% |

You Should Care About Profitability.

Now let’s look at the effect that profitability can have on the long-term value of a public company.

Tableau Software, in 2009, researched the fates of the largest market cap software IPO’s since 1980, and the data is startling:

https://blogs.wsj.com/venturecapital/2009/09/15/how-important-is-profitability-for-tech-ipos/

For the first two years, it doesn’t matter whether a company is profitable when it

IPOs. In fact, the non-profitable companies performed better than their profitable counterparts. After that, all I can say is that profitability sure does matter. By the end of Year 3:

•The companies that were profitable upon IPO were up an average of 160%

•The companies that were unprofitable upon IPO were up only 39%

I researched venture-backed IPO’s from 2012 using data from Jay Ritter at the University of Florida. That gives us at least three years of data.

The results are similar to Tableau’s results:

| Average Increase | Median Increase | |

| Cash Flow Positive at IPO | 278% | 111% |

| Cash Flow Negative at IPO | 74% | -24% |

The median profitable company has over doubled in value. The cash flow negative IPO's have actually lost money over the same time period.

Read Inc.’s interview with Steve Blank (Steve Blank on the Tech Bubble: 'VCs Won't Admit They're in a Ponzi Scheme') and Mark Suster’s recent post (https://www.linkedin.com/pulse/c...) for more.

Blank and Suster are both saying the same thing using different words: the obsession with Unicorn’s is unhealthy. But, I think I like Suster’s eloquent explanation even better:

Why I Fucking Hate Unicorns and the Culture They Breed

Suster believes the Unicorn culture is producing entrepreneurs and investors looking for shortcuts to wealth and glory:

“Do you know how many people I meet these days who are ‘packaging up money in SPV's (special purpose vehicles),’ or raising syndicates or doing secondaries or advising high-net-worth individuals how to get into unicorns? For a fee, of course.” ---Mark Suster

Blank believes we will go back (for a while) to the unwritten rule where private companies will be required to have five quarters of profitability before they can go public.

"The role of venture capital was to teach you how to turn your idea into a profitable company. The role of venture capital now is the greater fool theory." --Steve Blank

The problem with the greater fool theory is eventually there are no more fools that want to invest. As is always does, sanity eventually prevails.

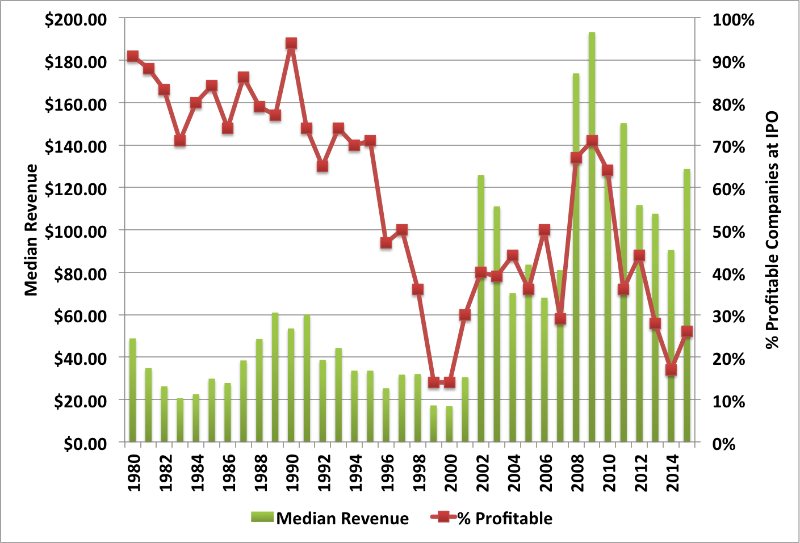

You can see how tech IPO's back in the day were as Blank remembers them, profitable:

The data clearly shows from 1980 through 1995 VC-backed tech IPO's were mainly profitable. However, you can also see that as the number of IPO's increased in the late 1990's, the quality of the IPO's decreased significantly.

The nature of IPO's has significantly changed since the tech bubble started building in the late 1990’s. Only in 2009, at the peak of the great recession, have the percentage of profitable VC-backed tech IPOs been above 70%. So, what has changed?

Bigger Is Not Necessarily Better

The rise of the Unicorns can be directly traced to two things:

- The Sarbanes-Oxley Act of 2002

- The increase in the number of “Megafunds” raised by VC firms

The Sarbanes-Oxley Act of 2002

There’s no denying the impact of Sarbanes-Oxley Act of 2002. Sarbanes-Oxley was enacted in reaction to corporate accounting scandals at Enron, Tyco, WorldCom, and others. The goal of Sarbanes-Oxley was to increase the oversight of accounting practices at public companies, so the investing public didn’t suffer through another Enron, Tyco, or WorldCom.

Sarbanes-Oxley was not enacted with the intention of preventing startups from going public. However, according to a survey conducted by Protivity, the costs of being complaint with Sarbanes-Oxley are over $1M initially for a private company preparing to go public.

The sustaining costs once a company is public average $474K per year for new companies. This keeps companies from going public.

The Increase in the Number of “Megafunds” Raised by VC's

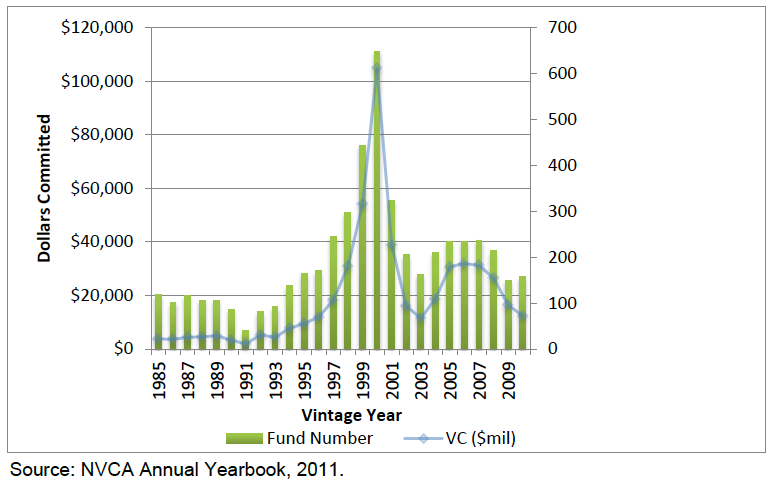

The National Venture Capital Association (NVCA) 2011 Yearbook shows the challenge for entrepreneurs: More money in fewer funds:

And, as the fund sizes get larger, the investments get larger because larger investments are the only way to “move the needle” of a $1B fund. Whether it’s coincidental or not, you can see that the valuations of tech companies that IPO’d increased dramatically after 2002:

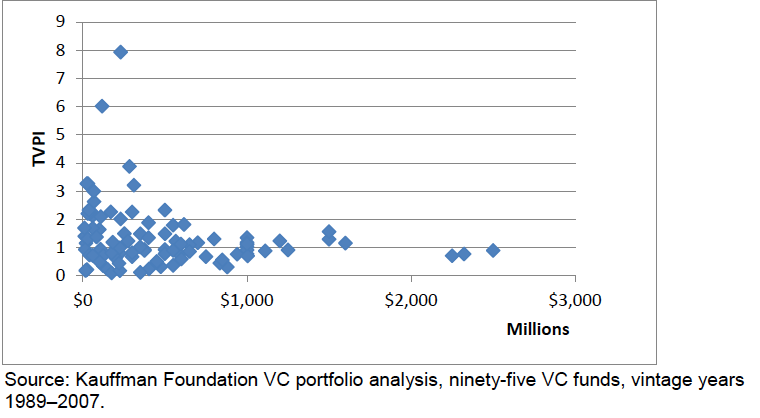

However, the increased fund size and the increase in Unicorns is not leading to bigger returns. In fact, just the opposite is happening. The Ewing Kauffman Foundation, in their 2012 report, provided data on how all their various venture investments were doing versus fund size.

You can clearly see that the best performing funds are significantly below $1B in size:

So, even though more money is going into Megafunds, it’s not helping anyone in the Venture Capital ecosystem. It’s so bad on so many levels:

- Too many businesses get started without any thought about achieving profitability, and…

- They are siphoning funds away from very good businesses that DO have a legitimate chance of being profitable. Worse yet…

- The valuations get pumped up in the beginning of the cycle, and…

- Money-losing companies IPO, and…

- Money-losing companies do significantly worse than profitable companies. Read (How Important Is Profitability For Tech IPOs?), and…

- Eventually the bubble bursts and valuations crumble, so…

- Unsuspecting entrepreneurs and retail investors are left holding the bag.

That’s why I’d like to see the SEC enact Blank’s Five Quarter Rule.

Imagine what would happen if private companies were required to have five quarters of profitability before they could IPO! You would:

- Have companies built on sound business principles getting funded, and…

- The boom/bust cycles would be lessened to some degree, and…

- Retail investors would not tempted to invest in companies that look sexy, but, in reality, have bleak futures.

Valuations For Unicorns Are Dropping In 2023.

In late 2022 and early 2023, the rise of the unicorns has finally stopped. Many of these unicorns were overvalued with no or little revenue to speak of.

And now, investors are no longer willing to pay up. Silicon Valley law firm , Cooley Godward, did a study of recent fundraisings, and the valuation for Series D fundraising is down over 85%! Most unicorns would be Series D fundraising.

So, unless your startup has real revenue and customers to support its valuation, you're in deep trouble.

What Does This Mean For Entrepreneurs? The Bar Has Been Raised.

The focus will return to frugality and profitability, and profitability never goes out of style. There will always be investors, like the one I met, who subscribe to the greater fool theory of investing. However, that breed of investing (at least for now) is going away.

Will the focus on Unicorns go away too? It will take time because the Megafunds aren’t going anywhere for now. However, if the inferior returns of Megafunds continue, eventually there will be fewer Megafunds.

Are you hoping to build a sustainable company built for the long term?

Then build a profitable company!

- Profitable businesses are always fundable, and…

- Profitable businesses can always IPO or be acquired, and…

- Profitability equals freedom.

One last time because it feels so good: Profitability equals freedom. It’s what every entrepreneur should strive for.

Long live high-margin, profitable businesses!

Do You Want To Grow Your Business? Maybe I Can Help. Click Here.

1. Data from https://site.warrington.ufl.edu/ritter/ipo-data/