Should You Follow Cramer’s Stock Market Tips?

The NASDAQ is up. The S&P is up.

Everyone is breathing a sigh of relief. Last week’s “correction” is over, and we're off to the races…again.

CNBC’s commentators are gushing: “Look at this board! 27 of 30 stocks are positive!!!” CNBC’s commentator just can’t contain his enthusiasm.

CNBC goes to break. The title of the next sequence is “NASDAQ Superstars.”

Cramer is equally enthusiastic. He starts his show like today is the greatest day ever: “We have an investable bottom!” Cramer even developed a ten-item checklist of items necessary for the market to have an investable bottom.

Cramer now says these ten items have been met. Cramer appears prescient.

Me? I just shake my head in wonder.

“I don’t know how people do it,” I said to my wife.

“Do what?”

“Invest the way Cramer suggests. I know he’s a really smart guy, but he’s constantly changing his opinion on various stocks and the stock market. “It’s enough to drive you crazy!”

“What do you mean?” my wife asks.

“Every day his opinion changes. One day, you should be buying stocks, the next day selling. Thank goodness, I don’t follow his methodology.

“I think we’d lose all our money if we did.”

That’s the problem with following the “experts”. Experts get paid for having an opinion.

In other words, Cramer gets paid to entertain us. That’s his primary focus.

That being said, I think he’s brilliant, and I know he truly wants to help people invest wisely.

Here's where I remind you of the difference between entertainment and advice: Entertainers must come up with new, entertaining content every single day. (At least, those with daily television shows need to do so.) Advice is a long-term matter. Great advice doesn't change daily. It changes in response to long-term developments.

When he's on TV, Cramer is performing. He's an entertainer, and the investment style he offers as entertainment just doesn’t work for me.

All you need to do is look at the headlines from his “Daily Booyah” email. Let’s look at the week of September 29 – October 3:

| Date | Cramer Booyah Topic | Dow Jones

Increase/Decrease |

| September 29 | “Use the Volatility to Make More Money” | -36 points |

| September 30 | “How to Invest in Slowing World Economy” | -27 points |

| October 1 | “Now is Not the Time to Panic” | -236 points |

| October 2 | “How to Cut Your Losses” | -7 points |

| October 3 | “Take the Other Side of Friday’s Panic Trade” | +207 points |

My goodness, Cramer. First you say make money when it’s volatile. Then, you say don’t panic. Then you talk about cutting losses. You wrap up the week talking about making money during a panic.

How can a normal, retail investor - that’s what people like you and me are called - keep up with your ever-changing advice?

They can’t. At least, I can’t.

Let’s fast-forward to the last six, tumultuous investing days:

| Date | Cramer Booyah Topic | Dow Jones

Increase/Decrease |

| October 15 | “More Nails in the Market's Coffin” | -36 points |

| October 16 | “The Selloff is not Done Yet” | -27 points |

| October 17 | “Wild Volume, Huge Volume and the Signs of a Fulcrum Day” | -236 points |

| October 20 | “Stick With Apple Over IBM” | -7 points |

| October 21 | “The Bulls are Back in Charge” | +207 points |

| October 22 | “The Machines are Ruining the Market | -153 points |

Look at October 21 and October 22. Imagine on the 21st, you’re saying, “Hallelujah!” Then on the 22nd, you’re saying, “Oh no!”

You are supposed to change your strategy from buying to selling in two days.? C’mon. It’s just too much.

You have to live and breathe the stock market every day to make money using Cramer’s advice. In other words, you have to be a trader.

Maybe there’s another way.

Let me rephrase that: THERE HAS TO BE ANOTHER WAY!

Let’s look at the advice of one Warren Buffett. His advice works in any market:

"Retain your belief in the real fundamentals of the business and to not get too concerned about the stock market."

In other words, ignore the daily changes in the stock market. Just make sure you own good businesses.

I was talking with a friend the other day. He was worried that he needed to buy stocks now “because they were cheap.”

Are stocks cheap?

The evidence says stocks are not cheap by any measure:

- The DOW is within 3% of its all time high. 3%!

- The NASDAQ is within 4% of its recent high. 4%!

Sorry, but that’s not a correction. It’s a minor blip, if that.

Re-enter the CAPE Index and the Undervalued/Overvalued Index

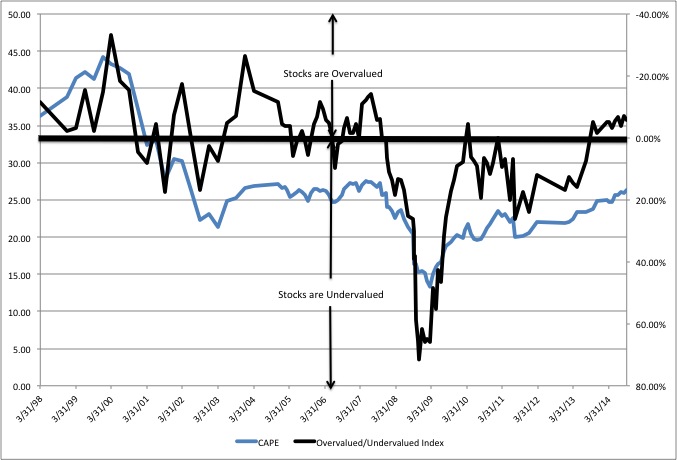

The Cyclically Adjusted Price Earnings Ratio, or CAPE, was invented by economists John Campbell and Robert Shiller. The CAPE is a stock's price divided by the 10-year earnings history adjusted for inflation, so it is similar to Benjamin Graham’s work.

Who is Benjamin Graham? He was Warren Buffet’s mentor and author of Buffet’s favorite book on investing, “The Intelligent Investor.”

The Undervalued/Overvalued Index is my own concoction. I developed a systematic methodology for determining if a given stock is undervalued, overvalued, or reasonably valued based on a stock’s ten-year earnings history. The method is partially based on Graham’s methodology to determine the earnings growth of a given company, and it’s partially based on Peter Lynch’s methodology to determine a company’s Adjusted Price to Earnings Ratio. I typically track between 100 and 150 companies. The stock market is overvalued if more of the stocks I am tracking are overvalued then undervalued.

What is do the CAPE and Undervalued/Overvalued Index tell us today:

The CAPE (the blue line) is near recent highs, and the Undervalued/Overvalued Index (the black line) indicate the market is still overvalued.

What does all this mean?

Warren Buffet has another great way to think about investing. Assume you can only make 20 investments in your lifetime. What would you invest in? It’s a great thought process to develop a long-term, disciplined approach to investing.

A long-term, disciplined approach to investing keeps you from making panicked decisions. A long-term, disciplined approach to investing is one of the best ways for retail investors like you and me to win in the market. Here’s my value, long-term approach to investing:

1 Sell any stock that is overvalued regardless of what the overall market is doing. My rule is a stock is overvalued if a stock is trading at over twice, based on the PE ratio, the ten-year growth rate.

2 Rebalance your portfolio when more stocks are overvalued than undervalued by trimming your positions in your largest holdings. Don’t own too much of any given stock, and don’t keep too much of your holdings in any one sector. Diversification is your friend.

3 Rebalance your portfolio keeping a minimum amount of cash on hand as a percentage of your overall net worth. It doesn’t matter what the percentage is, just be vigilant. Cash on hand, or “dry powder”, is great, so you can take advantage of the inevitable corrections and crashes that happen.

4 Be a buyer of stocks when more stocks are undervalued than overvalued. I want everything in my favor when I buy a stock. I want the market to be undervalued, and I want the stock to be undervalued when I buy. Do your homework and be disciplined.

5 Perform this analysis in regular increments. I perform the above four steps every month, and then I buy, sell, or both depending upon the results.

This investing style works well for me. I get an excellent return, and I mitigate downside risk. I am always buying stocks with a “margin of safety”.

Take advantage of this upturn in stocks before the market truly corrects. By truly correcting I mean a correction of greater then 10% or more from the peak. The current bull market is already the third longest in history:

1 January 1991 – October 1997 1,705 Days

2 May 2003 – November 2007 1,132 Days

3 August 1984 – October 1987 808 Days

4 November 2011 – Present 739 Days

5 January 1963 – June 1965 625 Days

It’s going to end. As noted investor Jimmy Cliff sang years ago, “And then the harder they come, the harder they fall, one and all.”

That’s all for now,

Brett

Photo: Depositphotos